Standard repayment plan calculator

If you choose the IBR plan your monthly student loan payment would be 149 which is 406 lower than your current monthly payment. This student loan payment calculator will provide you results on what your income-driven payment should be for your federal student loans.

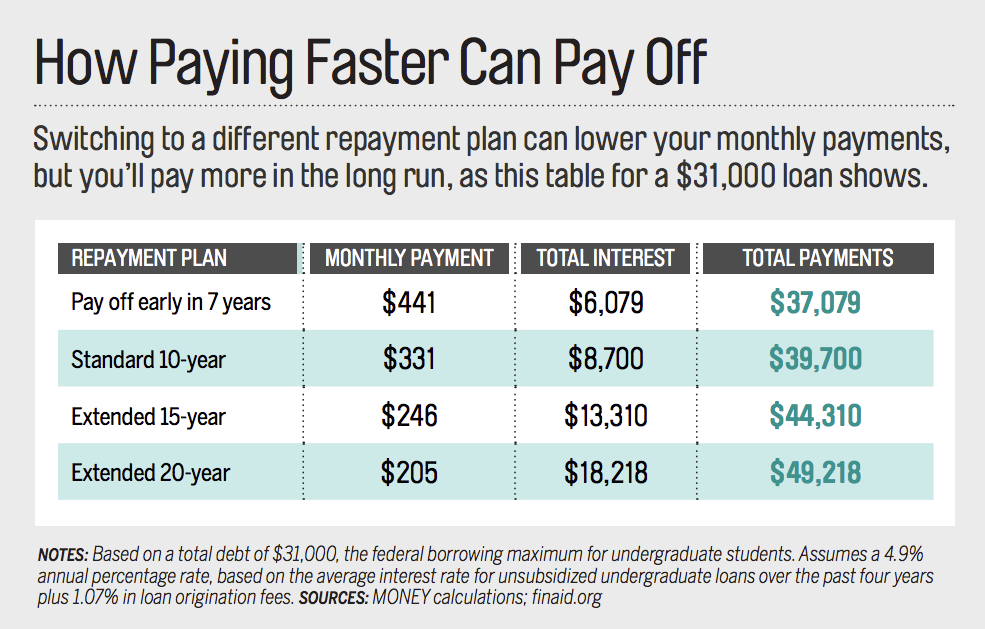

Student Loans Choosing The Best Student Loan Repayment Plan Money

Find a Dedicated Financial Advisor Now.

. Federal Student Aid. The calculator is preset to 120 months and an interest rate of 68. Federal Student Aid.

If your circumstances dont fit the repayment plans listed below we encourage you to call us at 8888664352 to discuss other alternatives. All income-driven repayment plans are. For student loan refinancing the participating lenders offer fixed rates ranging from 273 799 APR and variable rates ranging from 174 799 APR.

The maximum variable rate is. For student loan refinancing the participating lenders offer fixed rates ranging from 273 799 APR and variable rates ranging from 174 799 APR. An income contingent repayment calculator shows you what your monthly payment and total payment will be under the Standard Repayment Plan and student loan income-contingent.

When you graduate your 39 interest rate kicks in. Rated 1 by Top Consumer Reviews. Get a Free Consultation.

Ford Federal Direct Loan Direct Loan Program and Federal Family Education Loan FFEL Program. Do Your Investments Align with Your Goals. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

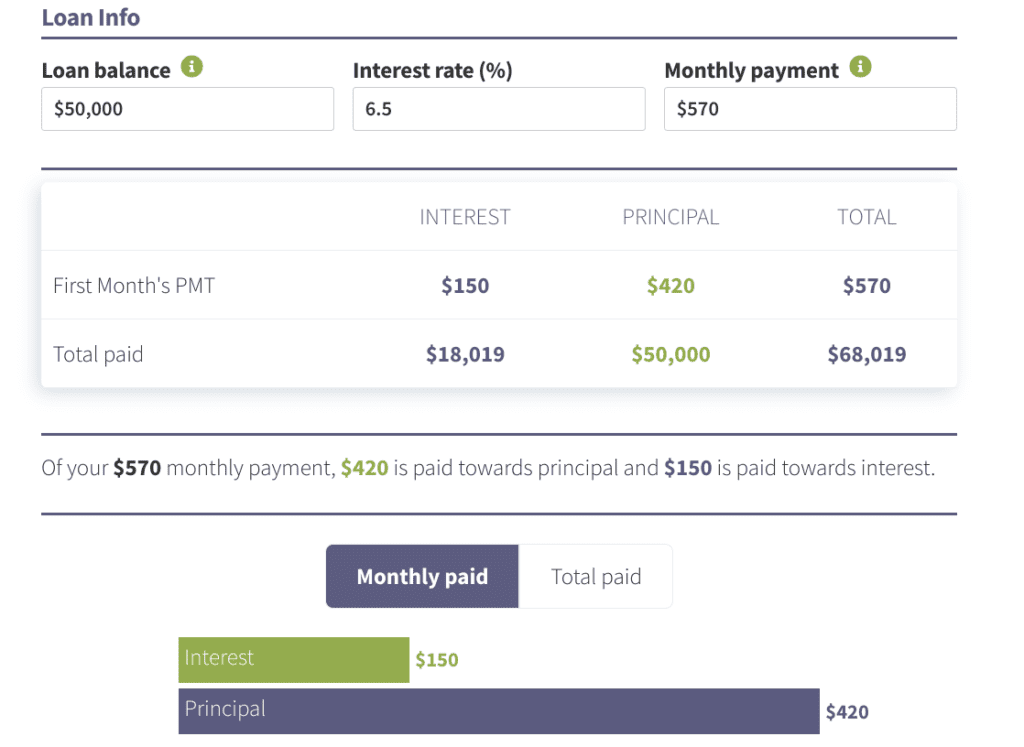

Estimate your student loan payments under a standard repayment plan equal payments using the calculator below. Finally multiply your discretionary income by 015 then divide that number by 12 to get your monthly REPAYE Plan payment. However most borrowers will end up with the standard plan when it comes time to repay the loans which is.

A good student loan repayment calculator takes into account the difference between subsidized and unsubsidized loans. The maximum variable rate is. Using the same numbers from the example above.

The results will not be. With an annual income. Ad BBB AFCC Accredited.

The Standard Repayment Plan is the basic repayment plan for loans from the William D. Federal Student Aid. Along with the specific ceiling of 23000 for subsidized Stafford.

For the standard repayment plan your monthly payments will be around 272 and will be paid off in 10 years. The calculator also assumes that the loan will be repaid in equal monthly installments through standard loan amortization ie standard or extended loan repayment. Plans based on the length of time in repayment.

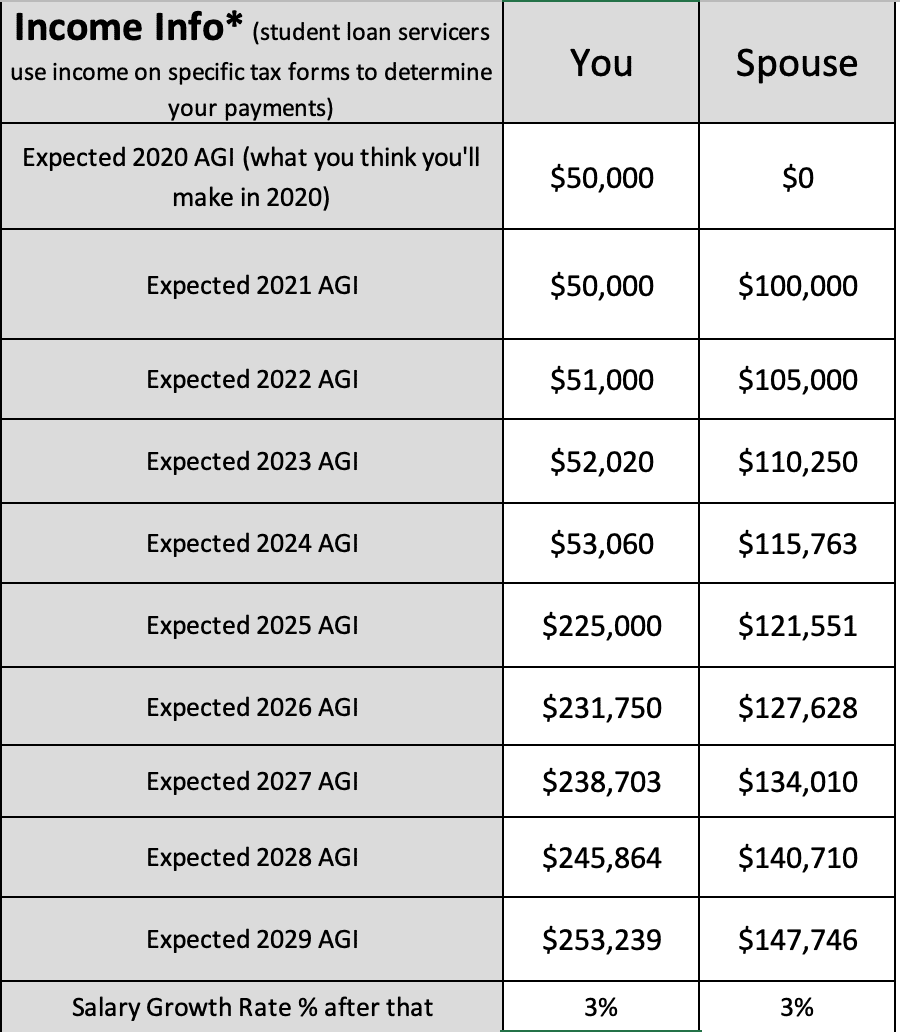

It is obvious through the table that many different loan repayment plans exist.

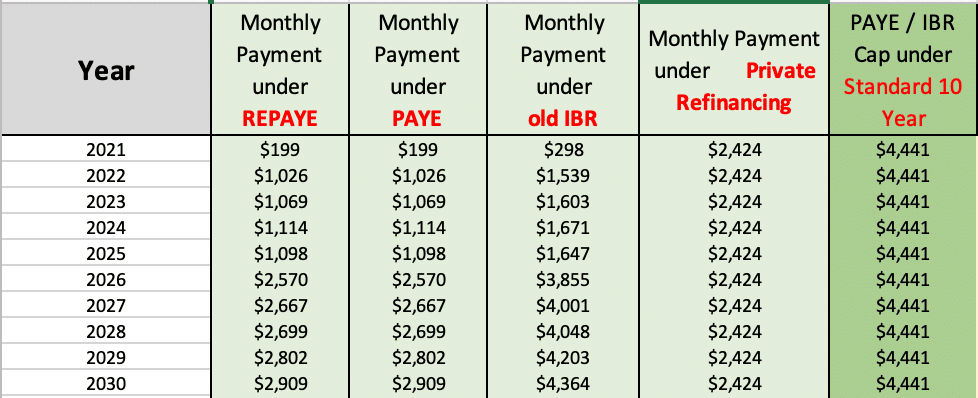

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

What Is Standard Repayment

Ibr Vs Icr How To Choose The Right Repayment Plan Student Loan Hero

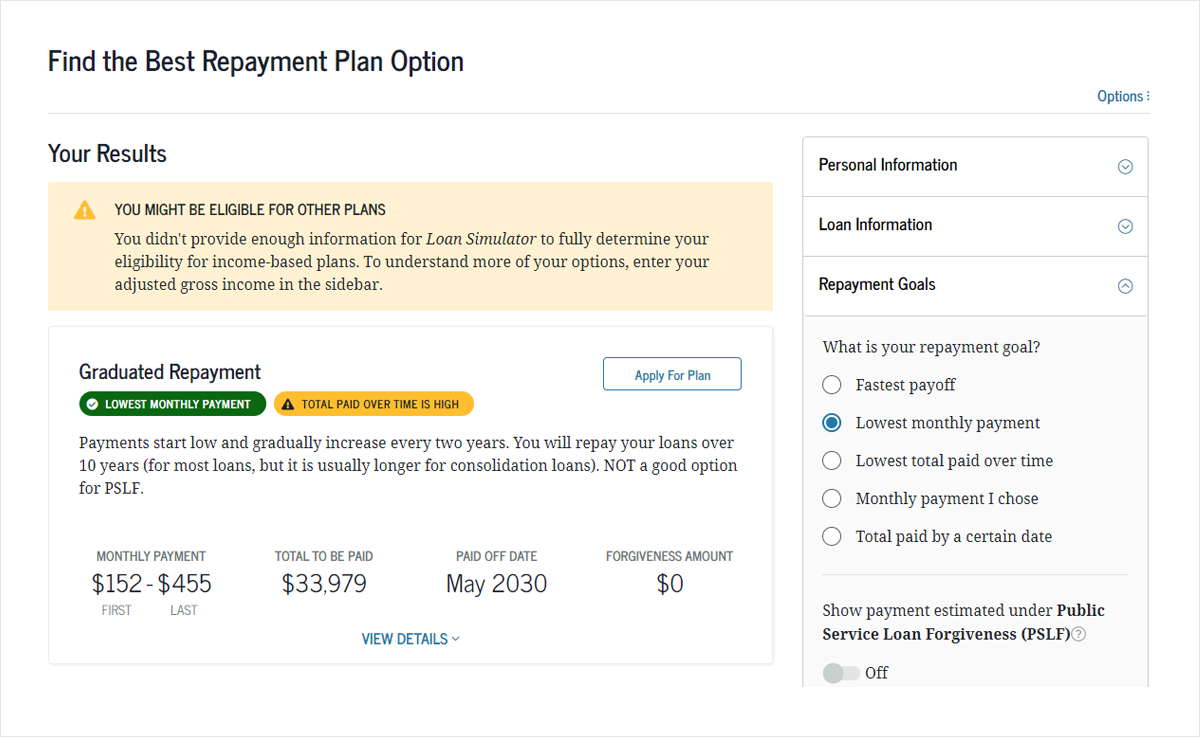

The Versatile Student Loan Calculator Loan Simulator Federal Student Aid

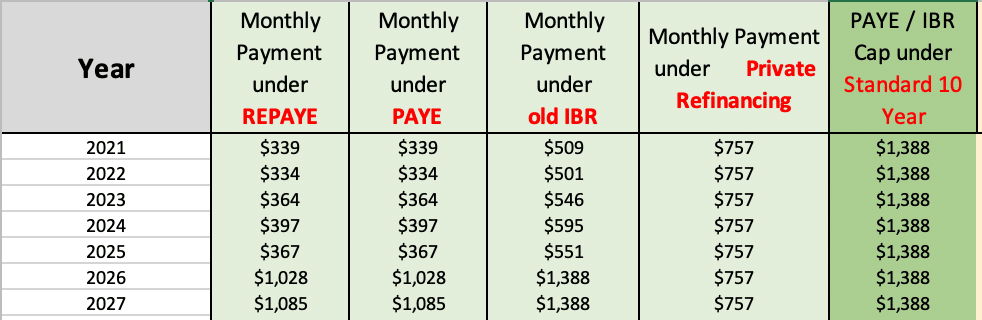

Income Based Repayment White Coat Investor

Pros And Cons Of Income Driven Repayment Plans For Student Loans

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

The Versatile Student Loan Calculator Loan Simulator Federal Student Aid

4 Must Dos Before Repaying Your Student Loans U S Department Of Education

Types Of Term Loan Payment Schedules Ag Decision Maker

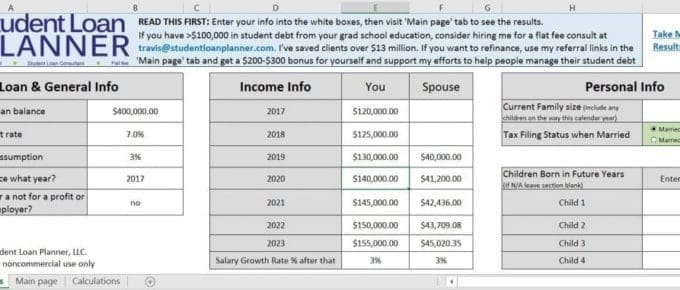

Free Calculators To Do Your Student Loan Forgiveness Math For You Student Loan Hero

Student Loan Repayment Calculator 2022 Forgiveness Ibr And Refi

Chapter 13 Calculator Quick And Easy 2022

Student Loan Interest Calculator Student Loan Planner

Income Based Repayment Calculator Includes Biden Ibr Plan

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

The Versatile Student Loan Calculator Loan Simulator Federal Student Aid